NCERT Solutions for Class 12 Macro Economics Introduction to Macroeconomics and its Concepts

Get easy Class 12 Economics textbook solutions Macro Economics Chapter-1 Introduction to Macroeconomics and its Concepts will give students an advantage with practical questions. NCERT Solutions provided are easy to understand Studyit.in Economics Solutions and each step in the solution is described to match student understanding. CBSE Class 12 Economics NCERT Solutions are curated by subject experts and students can rely on these to score well. NCERT Solutions Economics is prepared as per the latest CBSE Syllabus and you can use them during your homework or for your preparation.

Do you want to score high marks in economics in class 12 CBSE board Exams? Then following NCERT Solutions for Class 12 Economics free PDF can help you do it

NCERT Solutions for Class 12 Economics guides you through this with utmost precision by offering you easy access to important topics in every chapter – so that you save valuable time right before the exam.

NCERT TEXTBOOK QUESTIONS SOLVED

1. Describe the five major sectors in an economy according to the macroeconomic point of view.[3-4 Marks]

Ans: An economy may be’ divided into different sectors depending on the nature of study.

- Producer sector engaged in the production of goods and services.

- Household sector engaged in the consumption of goods and services.

Note: Households are taken as the owners of factors of production. - The government sector engaged in activities like taxation and subsidies.

- Rest of the world sector engaged in exports and imports.

- Financial sector (or financial system) engaged in the activity of borrowing and lending.

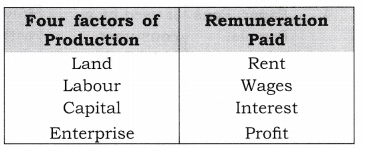

2. What are the four factors of production and remunerations to each of these called? [ 1 Mark]

Ans:

3. What are the important features of a capitalist economy? [3-4 Marks]

Ans: Features of capitalist economy are:

- Private ownership of land and capital.

- Profit is the only motive.

- Free play of the market forces of demand and supply.

- Government looks after growth, stability and social justice in the economy.

4. Describe the Great Depression of 1929. [3-4 Marks]

Ans: The Great Depression took place in 1929 which adversely affected the developed economies of Europe and North America. It continued for 10 years. There was extreme fall in aggregate demand due to fall in income, which led to a vicious circle of poverty.

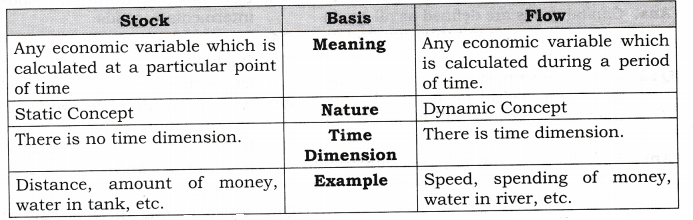

5. Distinguish between stock and flow. Between net investment and capital which is a stock and which is a flow? Compare net investment and capital with flow of water into a tank. [3-4 Marks]

Ans:

Net investment is a flow whereas capital is a stock. Amount of water in a tank at a particular point of time is a stock concept, whereas amount of water flowing into it is a flow concept.

MORE QUESTIONS SOLVED

I. VERY SHORT ANSWER TYPE QUESTIONS (1 Mark)

1. What is meant by circular flow of income?

Ans: It refers to flow of money income or the flow of goods and services across different sectors of the economy in a circular form.

2. What are the three phases of circular flow of income?

Ans: Production Phase, Distribution Phase and Disposition Phase.

Question 3. Give the meaning of factor income.

Ans: Income earned by factor of production by rendering their productive services in the production process is known as Factor Income.

4. What is meant by transfer income?

Ans: Income received without rendering any productive services is known as Transfer Income.

5. Out of factor income and transfer income which one is a unilateral concept?

Ans: Transfer income.

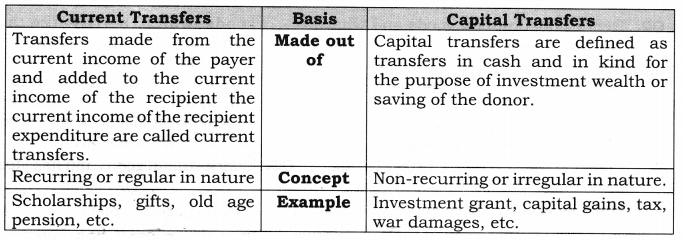

6. Define current transfers.[CBSE 2003]

Ans: Transfers made from the current income of the payer and added to the current income of the recipient (who receive) for consumption expenditure are called current transfers.

7. Define capital transfers.

Ans: Capital transfers are defined as transfers in cash and in kind for the purpose of investment to recipient made out of the wealth or saving of a donor.

8. What is the meaning of final goods?

Ans: These are those which are used for:

- Personal consumption (like bread purchased by consumer household), or

- Investment or capital formation (like building, machinery purchased by a firm)

9. What is meant by intermediate goods?

Ans: These are those, which are used for:

- Further processing (like sugar used for making sweets), or

- Resale in the same year (If car purchased by a car dealer for resale).

10. What is meant by consumption goods?

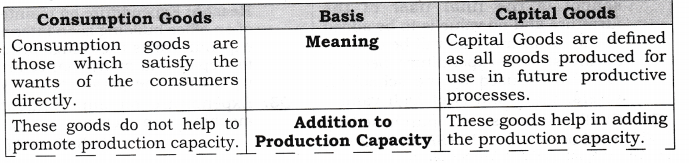

Ans: Consumption goods are those goods which satisfy the wants of consumers directly.

11. Define capital goods.

Ans: Capital goods are defined as all goods produced for use in future productive processes.

12. Give an example of a person who is staying abroad for a period more than one year and still he is treated as normal resident of India.

Ans: An Indian working in Indian Embassy in the USA will be treated as normal resident of India.

II. MULTIPLE CHOICE QUESTIONS (1 Mark)

1. Transfer payments refer to payments which are made:

(a) Without any exchange of goods and services.

(b) To workers on transfer from one job to another.

(c) As compensation to employees.

(d) None of these

Ans: (a)

2. Which one of the following items comes under consumption goods?

(a) Durable goods

(b) Semi-durable goods

(c) Non-durable goods

(d) All of these.

Ans: (d)

3. Service of a teacher:

(a) Capital goods

(b) Consumption goods

(c) Intermediate goods

(d) Can be Consumption goods and intermediate goods

Ans: (d)

4. In a circular flow of income, we have:

(a) Production (b) Distribution

(c) Disposition (d) All of them

Ans: (d)

5. Who is considered as agents of factor

of production,

(a) Households

(b) Government

(c) Rest of the world

(d) All of these

Ans: (a)

6. Which among the following are the

features of capitalist economy,

(a) Private ownership of Land and Capital.

(b) Profit is the only motive.

(c) Free Play of market forces of demand and supply.

(d) All of these

Ans: (d)

7. Flow of Goods & services and factors of production across different sectors in a barter economy is known as: [CBSE Sample Paper 2016]

(a) Circular flow (b) Real flow

(c) Monetary Flow (d) Capital Flow

Ans: (b)

III. SHORT ANSWER-TYPE QUESTIONS

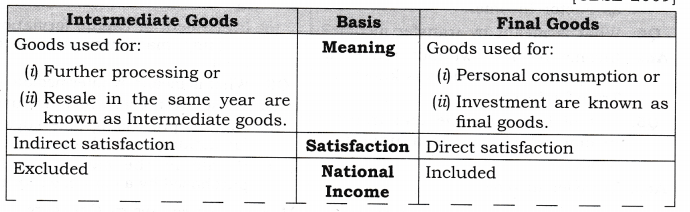

1. Explain the basis of classifying goods into intermediate and final goods. Give suitable examples. Or [CBSE 2010]

Distinguish between intermediate products and final products. Give examples. ‘ [CBSE 2009]

Ans:

2. Define consumption goods and what are its categories.

Ans: Consumption goods are those which satisfy the wants of the consumers directly.

For example, cars, television sets, bread, furniture, air-conditioners, etc. Consumption goods can further be subdivided into the following categories:

- Durable goods: These goods have an expected life time of several years and of relatively high value. They are motor cars, refrigerators, television sets, washing machines, air-conditioners, kitchen equipments, computers, communication equipments etc.

- Semi-durable goods: These goods have an expected life time of use of one year or slightly more. They are not of relatively great value. Examples are clothing, furniture, electrical appliances like fans, electric irons, hot plates and crockery.

- Non-durable goods: Goods which cannot be used again and again, i.e., they lose their identity in a single act of consumption are known as non durable goods. These are food grains, milk and milk products, edible oils, beverages, vegetables, tobacco and other food articles.

goods which satisfy the human wants directly. They cannot be seen or touched, i.e., they are intangible in nature. These are medical care, transport and communications, education, domestic services rendered by hired servants, etc.

3. Define capital goods and its categories.

Or

Define ‘capital goods’.[CBSE Foreign 2011]

Ans:

- Capital goods are defined as all goods produced for use in future productive processes.

- For example, All the durable goods like cars, trucks, refrigerators, buildings, air crafts, air-fields and submarines used to produce goods and services for sale in the market are a part of capital goods.

- Stocks of raw materials, semi finished and finished goods lying with the producers at the end of an accounting year are also a part of capital goods.

- Some more examples of capital goods are machinery, equipment, roads and bridges.

- These goods require repair or replacement over time as their value depreciate over a period of time.

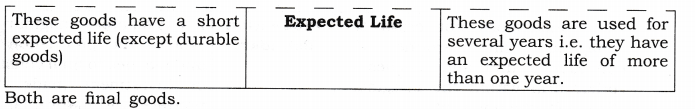

4. Distinguish between consumption goods and capital goods. Which of these are final goods? [CBSE Delhi 2010]

Ans:

5. Differentiate between Current transfers and Capital Transfers.

Ans:

IV. GIVE REASONS

A. Giving reasons, classify the following into intermediate or final goods.

1. Machines purchased by a dealer of machines. [CBSE (AZ) 2010]

Ans: Intermediate good

Reason: Machines purchased by a dealer of machines is an intermediate good because machines are resold by the firms to make profits or value is yet to be added to these goods by way of further processing.

2. A car purchased by a household.[CBSE (AI) 2010]

Ans: Final good

Reason: A car purchased by a household is a final good because the household is the final user of the car and no value is to be added to the car.

3. Furniture purchased by a school. [CBSE Delhi 2011]

Ans: Final good

Reason: Furniture purchased by a school is a final product because school is the final user of the furniture and no value is to be added to the furniture. This will be deemed as investment expenditure because furniture is used by the school for several years and is of high value.

4. Chalks, dusters, etc. purchased by a school. [CBSE Delhi 2011]

Ans: Intermediate good

Reason: Chalks, dusters, etc. purchased by a school are intermediate goods as these are used up in the process of value – addition during the year.

5. Computers installed in an office.[CBSE Delhi 2011]

Ans: Final good

Reason: Computers installed in an office is a final product because computers are finally and repeatedly used by the office for several years and these are of high value.

6. Mobile sets purchased by a mobile dealer. [CBSE Delhi 2011]

Ans: Intermediate product

Reason: Mobile sets purchased by a mobile dealer is an intermediate product because these are purchased for resale.

7. Expenditure on maintenance of an office building. [CBSE Delhi 2011]

Ans: Intermediate product

Reason: Expenditure on maintenance of an office building is an intermediate expenditure as the things purchased for repair and maintenance are used up during the period of one year.

8. Expenditure on improvement of a machine in a factory.[CBSE Delhi 2011]

Ans: Final Product

Reason: Expenditure on improvement of a machine in a factory is a final expenditure as the machine is repeatedly used for several years as a fixed asset. Improvement of a machine implies improvement of asset value (through investment expenditure).

9. Purchase of furniture by a firm.[CBSE (Al) 2010]

Ans: Final Product

Reason: Purchase of furniture by a firm is a final expenditure because furniture is repeatedly used by the firm for several years and this is of high value.

10. Expenditure on maintenance by a firm. [CBSE (AI) 2010]

Ans: Intermediate product

Reason: Expenditure on maintenance by a firm is an intermediate expenditure as the things purchased for repair and maintenance are used up during the period of one year.

11. Paper purchased by a publisher.

Ans: Intermediate product

Reason: It is an intermediate product as paper is used for further production during the same year.

12. Milk purchased by households.

Ans: Final product

Reason: It is a final product as it is used by households for final consumption.

13. Purchase of rice by a grocery shop.

Ans: Intermediate product

Reason: These are intermediate products because these are purchased for resale.

14. Coal used by manufacturing firms.

Ans: Intermediate product

Reason: It is an intermediate product as coal is used for further production during the same year.

15. Coal used by consumer households.

Ans: Final product

Reason: It is a final product as it is used by households for final consumption.

16. Purchase of pulses by a consumer.

Ans: Final Product

Reason: It is a final product as it is used by a consumer for final consumption.

17. Fertilizers used by the farmers.

Ans: Intermediate product

Reason: These are intermediate products because fertilizer is used for further production during the same year.

18. Printer purchased by a lawyer.

Ans: Final product

Reason: It is a final product because it is purchased for investment.

19. Wheat used by the flour mill.

Ans: Intermediate product

Reason: It is an intermediate product as wheat is used for further production during the same year or is meant for resale.

20. Unsold coal with trader at a year end.

Ans: Final product

Reason: It is a final product as the unsold coal is an investment for the trader.

21. Cotton used by a cloth mill.

Ans: Intermediate product

Reason: It is an intermediate product as cotton is used for further production during the same year.

22. Wheat used by households.

Ans: Final product

Reason: It is a final product as it is used by households for final consumption.

23. Refrigerator installed by a firm.

Ans: Final product

Reason: It is a final product because it is purchased for investment.

24. Sugar used by a sweet shop.

Ans: Intermediate product

Reason: It is an intermediate product as sugar is used for further production during the same year.

B. Giving reasons, classify the following into factor income or transfer income.

1. Unemployment allowances.

Ans: Transfer income

Reason: It is received without rendering any productive services.

2. Salary received by Pankaj from a company.

Ans: Factor income

Reason: It is earned by rendering productive services.

3. Financial help to earthquake victims.

Ans: Transfer income

Reason: It is received without rendering any productive services.

4. Compensation received from the employer.

Ans: Factor income

Reason: It is earned by rendering productive services.

5. Claim received from Insurance company by an injured worker.

Ans: Transfer income

Reason: It is received without rendering any productive services.

6. Birthday gift received from a friend.

Ans: Transfer income

Reason: It is received without rendering any productive services.

7. Bonus received on Diwali.

Ans: Factor income

Reason: It is earned by rendering productive services.

C. Giving reasons, classify the following into stock or flow.

1. Capital [GBSE 2013]

Ans: Stock concept

Reason: Capital is stock because it is measured at a point of time.

2. Saving [CBSE 2013]

Ans: Flow concept

Reason: Saving is flow because it is .measured during a period of time.

3. Gross Domestic Product [CBSE 2013]

Ans: Flow concept

Reason: Gross domestic product is a flow because it is measured during a period of time.

4. Wealth [CBSE 2013]

Ans: Stock concept

Reason: Wealth is stock because it is measured at a point of time.

5. Exports

Ans: Flow concept

Reason: It relates to a period of time.

6. Imports

Ans: Flow concept

Reason: It relates to a period of time.

7. Business capital of business

Ans: Stock concept

Reason: It is related to a point of time.

8. Investment

Ans: Flow concept

Reason: It relates to a period of time.

9. Foreign Investment

Ans: Flow concept

Reason: It relates to a period of time.

10. Foreign Assets

Ans: Stock concept

Reason: It relates to a point of time.

11. Foreign Remittances (In flow of money)

Ans: Flow concept

Reason: It is related to a period of time.

12. Production of Wheat

Ans: Flow concept

Reason: It is related to a period of time.

13. Income of a servant

Ans: Flow concept

Reason: It is related to a period of one month or one year.

14. Budget Expenditure

Ans: Flow concept

Reason: It is related to a period of time. (1 year)

15. Money supply

Ans: Stock concept

Reason: It relates to a particular point of time.

16. Machinery of a firm

Ans: Stock concept

Reason: It relates to a point of time.

17. A five hundred rupee note

Ans: Stock concept

Reason: It is related to a point of time.

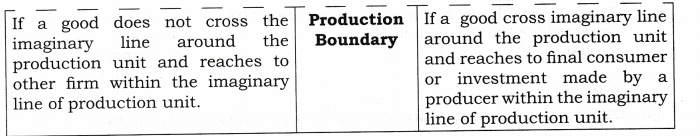

D. Giving reasons state whether the following are included or excluded in/from domestic territory.

1. An Indian Company in America

Ans: Excluded

Reason: As it is outside the domestic territory of our country.

2. Microsoft Office in India

Ans: Included

Reason: As it is within the domestic territory of our country.

3. Company in India owned by an American

Ans: Included

Reason: As it is within the domestic territory of our country.

4. Office of Tata in New York

Ans: Excluded

Reason: As it is outside the domestic territory of our country.

5. Branch of Foreign Bank in India

Ans: Included

Reason: As it is within the domestic territory of our country.

6. Indian Embassy in China

Ans: Included

Reason: As it is within the domestic territory of our country.

7. Branch of Punjab National Bank in America

Ans: Excluded

Reason: As it is outside the domestic territory of our country.

8. Russian Embassy in India

Ans: Excluded

Reason: As it is outside the domestic territory of our country.

9. Reliance Industries rented its building to Microsoft in America.

Ans: Excluded

Reason: As it is outside the domestic territory of our country.

E. Classify the following into durable, non-durable, semi-durable or services

1. Refrigerator

Ans: Durable

Reason: As it has expected life time of several years and of relatively high value.

2. Clothes

Ans: Semi-durable

Reason: As it have an expected life time of use of one year or slightly more.

3. Edible oil

Ans: Non-durable

Reason: As it loose their identity in a single act of consumption.

4. Tuition given by a teacher

Ans: Service

Reason: As it is non-material goods which satisfy the human wants directly.

5. Visit of a physician

Ans: Service

Reason: As it is non-material goods which satisfy the human wants directly.

6. Washing soaps

Ans: Non-durable

Reason: As it loose their identity in a single act of consumption.

F. Classify the following into consumer, intermediate or capital goods.

1. Milk used by a manufacturer of sweets.

Ans: Intermediate goods

Reason: As it is used up while making sweets.

2. Cycle purchased by a consumer household

Ans: Consumer goods

Reason: End user is consumer.

3. Textile machinery

Ans: Capital goods

Reason: End user is producer.

4. Construction of a house

Ans: Consumer goods

Reason: End user is consumer.

5. Bread and butter used by a consumer household.

Ans: Consumer goods

Reason: End user is consumer.

6. Services of a private doctor purchased by a consumer household.

Ans: Consumer goods

Reason: End user is consumer.

7. Fertilizer used by a farmer.

Ans: Intermediate goods

Reason: As fertilizer is used for further production during the same year.

8. Passenger bus service used by a consumer household.

Ans: Consumer services

Reason: End user is consumer.

G. Giving reasons, classify the following into normal resident of India or not.

1. Indian officials working in the Indian Embassy in USA.

Ans: Normal Resident

Reason: As their centre of economic interest lies in the home country.

2. A Japanese tourist who stays in India for 2 months.

Ans: Not a Normal Resident

Reason: As their centre of economic interest lies in the foreign country.

3. Indians going to Pakistan for watching the cricket match.

Ans: Normal Resident

Reason: As their centre of economic interest lies in the home country.

4. Indians working in the UNO office, located in America for less than 1 year.

Ans: Normal Resident

Reason: As their centre of economic interest lies in the home country.

5. Indian employees working in WHO, located in India.

Ans: Normal Resident

Reason: As their centre of economic interest lies in the home country.

6. Foreign tourists visiting India for a month to see the Taj Mahal.

Ans: Not a Normal Resident

Reason: As their centre of economic interest lies in the foreign country.

V. TRUE OR FALSE

Giving reasons, state whether the following statements are true or false.

1. Macroeconomics deals with the problems of a consumer.

Ans: False: It deals with problems of the economy.

2. Money flow is also known as physical flow.

Ans: False: Real flow is known as physical flow. Money flow is known by the name of nominal flow.

3. In a two-sector economy, total production is always equal to total consumption.

Ans: True: It happens because firms sell their entire output to the households.

4. Circular flow of income takes place in case of open economy and close economy.

Ans: True: Even in case of closed economy, circular flow of income takes place between households and firms.

5. Capital formation is a flow.[CBSE Sample Paper 2010]

Ans: True: Capital formation is measured over a period of time

6. Foreign remittances are a stock concept.

Ans: False: It is flow concept as these are assessed over a period of time and not at a point of time.

7. National Income of a country- is a stock concept.

Ans: False: It is a flow concept as it is measured over a period of time.

8. Bread is always a consumer good.[CBSE Sample Paper 2010]

Ans: False: It depends on the use of bread. When it is purchased by a household, it is a consumer good. If it is purchased by a restaurant, it is a producer intermediate goods.

9. Television is a capital good.

Ans: False: Television is a durable consumption good.

10. Services of a teacher is a consumption good.

Ans: True: It directly satisfies human wants.

11. Books in a library are intermediate goods.

Ans: False: Books used in a library are final goods as these are used by the end user.

12. Use of raw material is a consumption good.

Ans: False: Use of raw material helps in production process therefore it is a single use producer good. But it has no longer life.

13. Can purchase of a new car be categorized as an intermediate good.

Ans: True: Purchase of a new car can be categorized as an intermediate good, if purchased by a Government for military use or if it is purchased by a car dealer for resale.

14. A good can be an intermediate goods in one case and a final goods in another case.

Ans: True: A good can be an intermediate goods or final goods, depending upon its nature of use. For example, a car purchased by a household is a final good, whereas, it will be an intermediate good if it is purchased by a car dealer.

15. The concept of normal resident applies to individuals only.

Ans: False: The concept applies to institutions also, in addition to individuals.

16. In final goods, no value is to be added.

Ans: True: Because final goods have crossed the production boundary.

17. Transfer income is a part of factor income.

Ans: False: It is not a factor income, It is paid for without receiving any goods and services.

VI. HIGHER ORDER THINKING SKILLS

1. Explain that Domestic territory is bigger than the political frontiers of a country.

Ans: In layman terms, the domestic territory of a nation is understood to be the territory lying within the political frontiers (or boundaries) of a country. But in national income accounting, the term domestic territory is used in a wider sense. Based on ‘freedom’ criterion, the scope of economic territory is defined to cover:

- Ships and air crafts owned and operated by normal residents between two or more countries. For example, Indian Ships moving between China and India regularly are part of domestic territory of India. Similarly, planes operated by Air India between Russia and Japan are part of the domestic territory of India. Similarly, planes operated by Malaysian Airlines between India and Japan are a part of the domestic territory of Malaysia.

- Fishing vessels, oil and natural gas rigs and floating platforms operated by the residents of a country in the international waters where they have exclusive rights of operation. For example, Fishing boats operated by Indian fishermen in international waters of Indian Ocean will be considered a part of domestic territory of India.

- Embassies, consulates and military establishments of a country located abroad. For example, Indian Embassy in Russia is a part of the domestic territory of India.

‘Consulate’ is an office or building used by consul (an officer commissioned by the government to reside in a foreign country to promote the interest of the country to which he belongs).

2. “All Producer Goods are not Capital Goods”. Explain.

Ans: Producer goods are all those goods which are used in the process of production i.e., which are used in the production of other goods. Producer goods include two types of goods:

- Single-use Producer Goods: Goods used as raw material by the producers. It includes raw material like coal, wood, etc. They are not capital goods as they cannot be repeatedly used in the production process.

- Capital Goods: Goods which are used as fixed assets by the producers, like plant and machinery, which can be repeatedly used in the production process.

So, it can be said that all capital goods are producer goods, but all producer goods are not capital goods.

3. “Machine purchased is always a final good.” Do you agree? Give reasons for your answer.

Ans: No, it is not necessary that machine purchased is a final good. It will depend upon its use.

- If a machine is purchased by a household, then it is a final good. For example, washing machine purchased by a consumer household is a final goods.

- If it is purchased by a firm for its own use, then it is also a final good. For example, refrigerator purchased by a firm.

- If it is bought by a firm for resale, then it is an intermediate good. For example, machine purchased by a machine dealer.

4. “ Machine purchased is always a capital good.” Do you agree? Give reasons for your answer.

Ans: No, it is not necessary that machine purchased is a capital good. It will depend upon its use.

- If a sewing machine is purchased by a tailor, then it is a fixed asset of the tailor and considered to be a capital good. But the same machine purchased by a consumer household is considered to be a durable use consumer goods.

- If a car purchased by a taxi driver as a taxi or if purchased by a firm for use in its business is a capital good. But the same car purchased by a consumer household is a durable use consumer goods.

Note: So, finally, the end user of a good determine, whether it is capital good or durable use consumer goods. If an end user of a durable goods is a producer, it is a capital good. If an end user of a durable goods is a consumer household, it is a durable use consumer goods. So, capital goods are only those durable goods which are used as producer goods, not as consumer goods.

VII. VALUE BASED QUESTION

1. Compensation to flood victims is a good social security measure by the government. But why is it not included in the estimation of national income?

Ans: Because this is a transfer payment. Value: Implement of Knowledge

VIII. APPLICATION BASED QUESTIONS

1. The concept of domestic territory helps to estimate ‘Domestic Product’. Defend or refute.

Ans: The concept of domestic territory helps to estimate ‘Domestic Product’. As we know Domestic Product includes goods and services produced by production units located in the domestic territory (irrespective of fact whether carried out by residents or non-residents). The money value of domestic product is termed as Domestic Income.

2. The concept of Normal Resident helps to estimate ‘National Product’. Defend or refute.

Ans: The concept of Normal Resident helps to estimate “National Product’. National Product includes production activities of normal residents irrespective of fact whether performed within the economic territoiy or outside it. The money value of national product is termed as National Income.

CBSE Economics For class 12

0 Comments

Please Comment